BBPS is a complete platform that centralises invoice funds for numerous companies

The Union Funds 2024 focuses on enhancing fintech infrastructure, supporting MSMEs with data-driven options, and advancing applied sciences like AI and blockchain

With advances in expertise like AI and blockchain, India is on monitor to change into a pacesetter in monetary expertise

India’s push for a cashless financial system has seen vital developments, notably with integrating bank card funds into the Bharat Invoice Fee System (BBPS). The Reserve Financial institution of India (RBI) has mandated that each one bank card invoice funds be routed via BBPS, positioning it on the forefront of India’s digital fee panorama.

This transfer enhances safety and transparency, minimises fraud, and gives a unified fee interface. The rise of BBPS, alongside rising options like credit score on UPI, which permits on-demand borrowing, underscores the evolving digital funds ecosystem. In accordance with a PwC report, India’s digital funds sector grew at a CAGR of about 50% from 2015–16 to 2019–20, reflecting the speedy adoption and innovation on this area.

What Is BBPS?

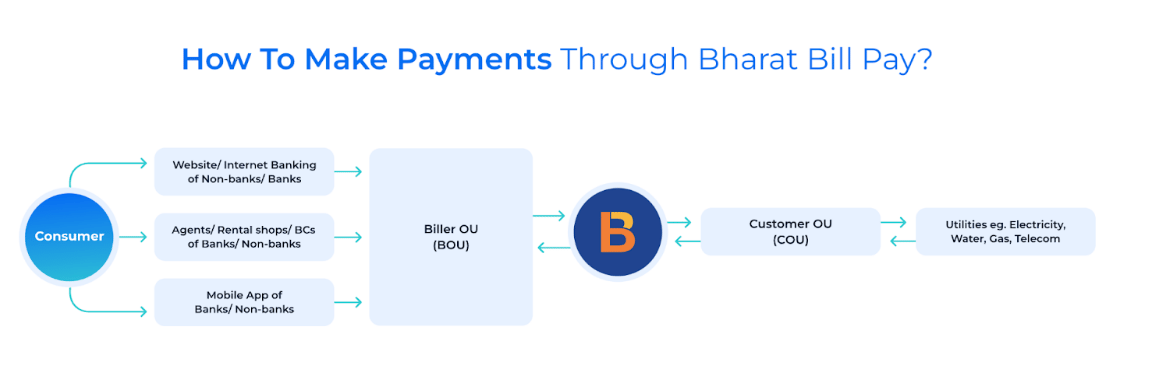

BBPS is a complete platform that centralises invoice funds for numerous companies. Beginning July 1, the RBI mandated that each one bank card funds via third-party purposes should be processed by way of BBPS, overseen by the Nationwide Funds Company of India (NPCI). This regulation goals to enhance oversight and regulation of bank card transactions, which beforehand bypassed centralised methods via direct transfers like NEFT/IMPS.

Past bank card funds, BBPS has expanded its attain into numerous different fee modes. Universities now undertake BBPS for seamless price assortment, enabling college students and fogeys to pay schooling charges via their most well-liked banks, cell apps, or wallets. Moreover, BBPS simplifies utility invoice funds, providing a single interoperable system for purchasers to handle every part from electrical energy to water payments.

BBPS can be a fast-emerging software within the mortgage compensation sector, particularly for small-ticket loans and bank card dues that require guide repayments. Whereas many massive loans, equivalent to residence and auto loans, are managed via auto-debit mandates, BBPS gives comfort to those that want to deal with their funds manually. Initially embraced by non-banking finance corporations (NBFCs) for EMI collections, massive banks additionally undertake BBPS to ship fee assortment requests, additional cementing its function in India’s evolving digital fee panorama.

Tech Infrastructure: The Spine Of Fintech

The Union Funds 2024 focuses on enhancing fintech infrastructure, supporting MSMEs with data-driven options, and advancing applied sciences like AI and blockchain, with key investments in high-speed web, knowledge centres, and cybersecurity. McKinsey’s analysis predicts that fintech revenues will develop almost thrice quicker than conventional banking from 2023 to 2028, highlighting the significance of a strong tech infrastructure.

BBPS: A Mannequin For Environment friendly Fintech Infrastructure

BBPS exemplifies the transformative potential of a well-structured fintech infrastructure. By establishing a unified platform for invoice funds, BBPS has considerably streamlined processes for each clients and billers, demonstrating the vital function of interoperability, knowledge standardisation, and sturdy system integration. BBPS’s success highlights how a fastidiously deliberate infrastructure can drive effectivity and scalability, serving as a mannequin for different Fintech initiatives.

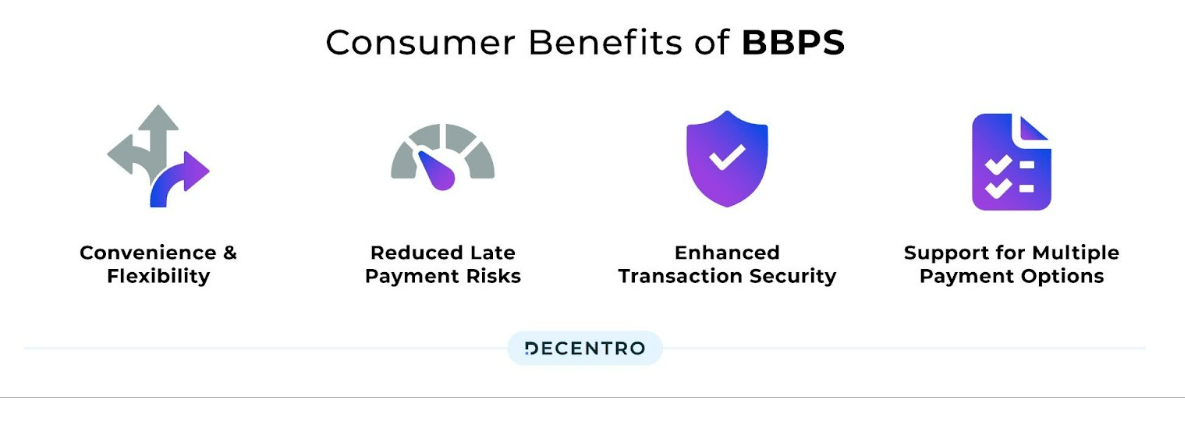

Advantages For Buyer

BBPS gives clients with handy, versatile invoice funds via a number of channels, together with cell apps and ATMs. It reduces late fee dangers with well timed notifications and ensures transaction safety with enhanced protocols. Supporting numerous fee choices, BBPS aligns with the rising desire for digital funds, as PwC’s June 2022 report highlights.

Advantages for Billers

For billers, BBPS enhances attain, will increase income, and simplifies integration. It gives detailed transaction stories and a strong grievance system, bettering operations and constructing buyer belief.

The Bharat Invoice Fee System (BBPS) goals to remodel India’s invoice fee panorama by consolidating numerous payments right into a single platform. This centralisation simplifies funds, enhances monetary oversight, reduces fraud via standardised safety, and improves transparency with detailed reporting. It additionally gives beneficial knowledge on fee behaviours to tell regulatory insurance policies and monetary methods.

The Bharat Invoice Fee System (BBPS) is poised to revolutionise the invoice fee course of in India, providing vital advantages for shoppers, companies, and the monetary ecosystem. Nonetheless, as with all transformative initiative, BBPS faces challenges that should be addressed to grasp its full potential.

Position Of Expertise Service Suppliers (TSPs)

Having established BBPS’s function in revolutionising how payments are paid throughout India, it’s time we have a look at what sits on the coronary heart of this sturdy ecosystem: Expertise Service Suppliers (TSPs), who play an instrumental function in making certain the seamless operation and success of BBPS. By enabling seamless onboarding of billers and brokers, making certain environment friendly fee processing, and integrating the BBPS platform with numerous stakeholders, TSPs present the mandatory infrastructure and technical experience to facilitate safe and scalable transactions.

As BBPS continues to develop its attain and influence, the function of TSPs will solely develop in significance. Their contributions to integration, safety, scalability, innovation, and assist are vital to the platform’s ongoing success. By facilitating clean, safe, and environment friendly invoice funds, TSPs are serving to to drive the digital transformation of India’s monetary ecosystem. Because the BBPS evolves, so will the function of TSPs, making them indispensable companions within the journey in direction of a cashless and inclusive financial system.

Brief-Time period Disruption For Shoppers

One of many fast challenges of BBPS is the potential disruption for shoppers accustomed to their most well-liked fintech platforms. This shift requires customers to regulate to a unique interface and fee course of, which could trigger non permanent inconvenience and resistance.

Integrating BBPS requires fintech changes, which influence operations and buyer interactions. Regardless of preliminary challenges, BBPS goals to reinforce India’s digital funds with a unified, safe platform. Advantages like centralised funds and decreased fraud will change into extra obvious over time.

BBPS And The Fintech Trade

BBPS bridges conventional invoice fee strategies with digital platforms like Paytm and PhonePe. By providing a unified system, BBPS enhances transaction effectivity and gives vital benefits to agent establishments, equivalent to seamless integration into the BBPS community and elevated income potential via further invoice funds. BBPS additionally gives value-added companies like invoice reminders, auto-payments, and consolidated invoice administration, bettering buyer expertise.

Funds 2024 And The Fintech Ecosystem

The Union Funds 2024 highlights the federal government’s dedication to strengthening the fintech infrastructure, which is essential for monetary innovation and inclusion. Key initiatives embody supporting MSMEs with data-driven monetary options and specializing in AI and blockchain applied sciences. This method promotes collaboration between the federal government and fintech corporations, emphasising the necessity for superior digital infrastructure and the digitisation of monetary processes.

Increasing The Fintech Ecosystem

BBPS reveals how essential sturdy methods are for bettering digital funds. By making funds smoother and safer, BBPS is bettering how we pay at this time and opening doorways for future improvements. As the federal government invests in higher digital methods, like safe identification checks and open connections between platforms, BBPS will assist drive the fintech trade ahead. With advances in expertise like AI and blockchain, India is on monitor to change into a pacesetter in monetary expertise.