Whereas inventory markets intimidate risk-averse buyers, those with a high-risk urge for food can’t get sufficient of the joys. Nicely, risk-averse or not, there’s nothing just like the euphoria when a guess pays off. Nonetheless, even probably the most adept inventory market buyers have been as soon as learners and uncovered to poorly researched ideas and shallow suggestions to outlive the brutal inventory market volatilities.

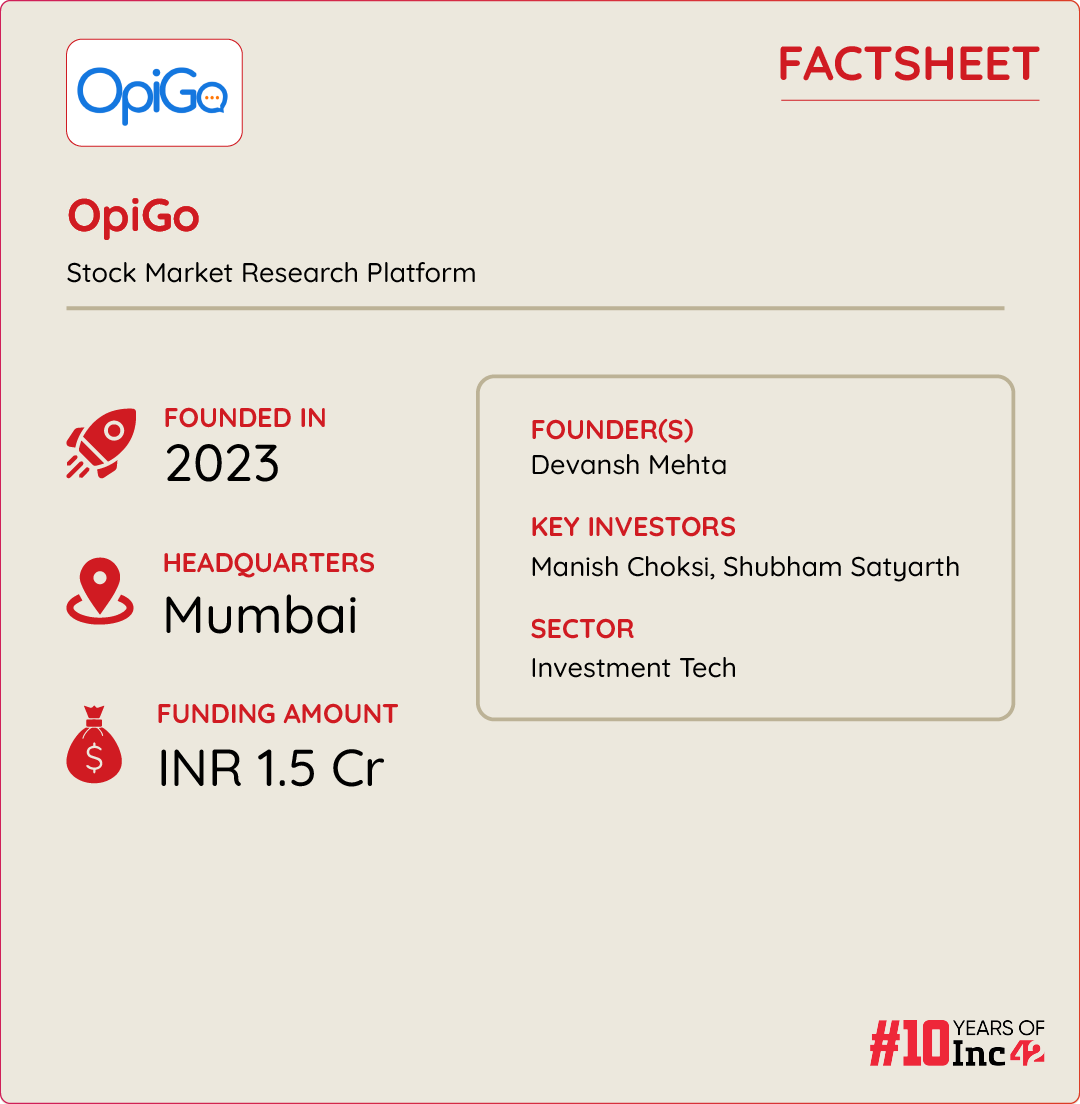

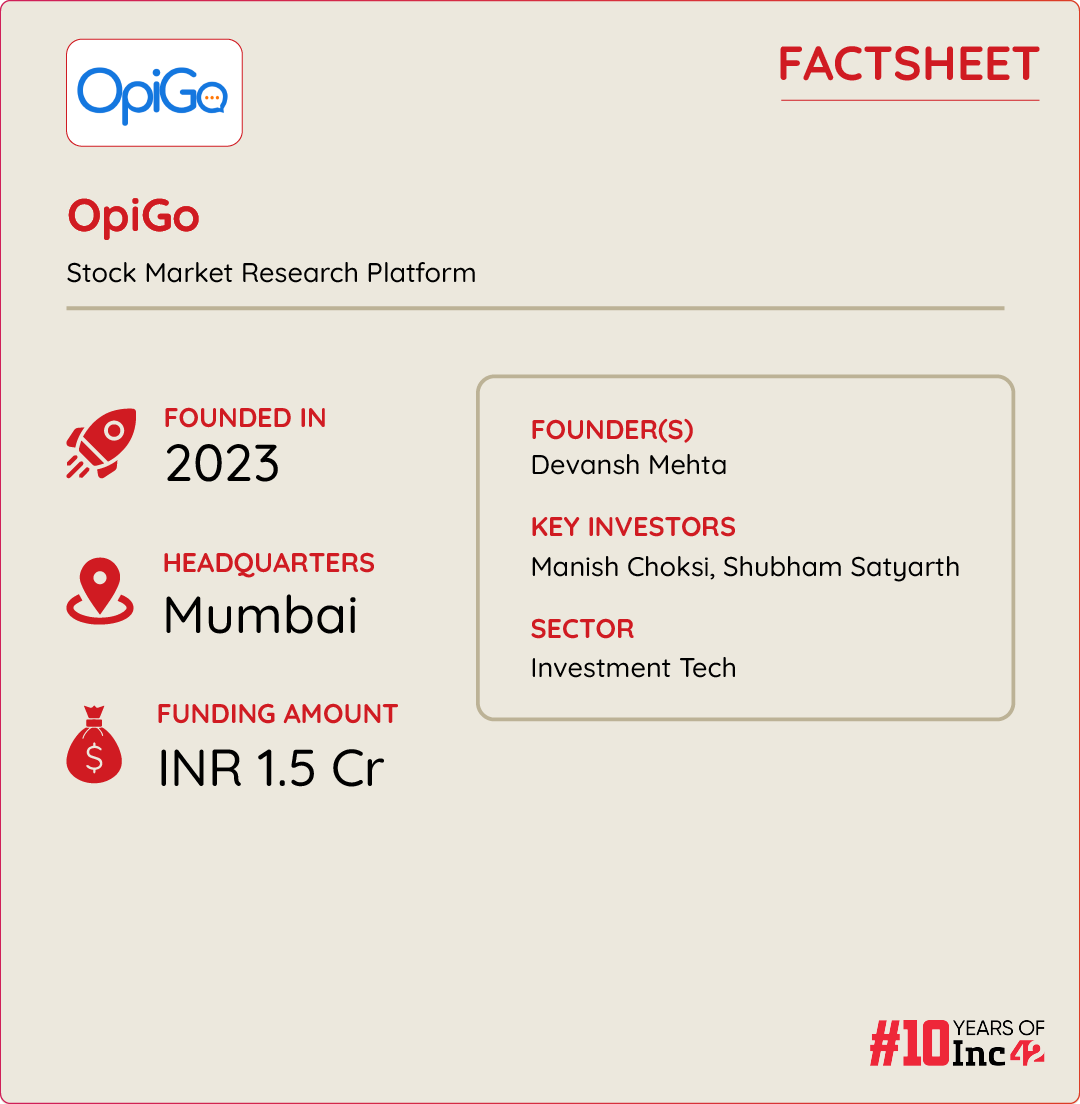

It’s this white house that Mumbai-based Devansh Mehta determined to fill and constructed OpiGo, a platform to find and share new inventory concepts, in 2022. OpiGo is a tech platform that gives inventory suggestions from SEBI-registered consultants, giving insights into short-term trades, long-term investments, and industries or sectors.

Now, earlier than we clarify how Mehta is creating waves with its tech platform, let’s steal a look on the founder’s journey up to now.

Talking with Inc42, Mehta stated that he tasted the joys of inventory market returns when he was simply 15 years outdated. Rising up in a household the place investments and finance have been mentioned virtually every day on the dinner desk, it was solely pure for him to study the ropes, which he did fairly early on in his life.

Given his curiosity within the discipline, he selected to change into a chartered accountant (CA). After incomes his chartered accountant (CA) diploma, he began working with Blackstone’s India asset and wealth administration enterprise, ASK group, in 2019.

Right here, he would seek the advice of household workplaces and high-net-worth people relating to their investments. As days handed, he witnessed a typical challenge — lots of his purchasers have been investing with none in-depth analysis or data concerning the firm,

“I witnessed such unreliable inventory suggestions and predictions clouding purchasers’ capacity to make first rate bets. This case solely acquired worse in the course of the Covid-19 pandemic when the nation noticed a pointy rise in demat accounts,” the founder stated.

Throughout this time, he surveyed his purchasers (principally retail buyers spanning completely different ages and revenue brackets) to grasp their funding theses. He was boggled to seek out that greater than 70% of retail buyers relied on options from household and buddies for his or her investments, whereas only some relied on paid monetary advisors or on their analysis.

Recognising this hole, the younger finance skilled started exploring methods to plug the hole. He then considered a platform that would present inventory merchants with numerous views on their fairness funding plans.

This impressed Mehta to construct a web-based neighborhood of retail buyers that would foster discussions and allow the mixing of professional insights into funding plans.

The Genesis Of OpiGo

When Mehta sat down on the drafting board, he ready all the roadmap of a retailer’s funding journey. He realised that the inventory funding path travels by way of 4 essential junctures — brokerage platforms, analysis platforms, communities and advisory companies.

Whereas brokerage platforms like Zerodha, Upstox and Groww permit one to make their supposed investments, analysis platforms like MoneyControl and Trendlyne affect their choice. Communities resembling X and Telegram additionally serve this function. Nonetheless, an additional cautious investor makes bids solely after checking with an skilled guide.

Mehta discovered his calling in neighborhood constructing and advisory, all whereas realising that he has to remain one step forward of points like spamming and junk options (a serious challenge for current communities) if his platform have been to make waves.

“I made a decision to create an interactive platform that rewards customers with monetary incentives and recognition for correct predictions,” Mehta stated.

A eager observer of UI/UX tendencies, Mehta envisioned OpiGo as a platform with an intuitive design that even non-finance customers may navigate simply.

Whereas nonetheless employed at ASK, he initially engaged an company to develop the app and its interface in late 2022. Nonetheless, dissatisfied with the outcomes, he assembled a crew of freelance builders and straight supervised the venture. By early 2023, OpiGo was prepared for launch.

The platform supplies buyers entry to community-driven opinions on numerous shares. For instance, if an investor is seeking to purchase a inventory, he/she will discover OpiGo’s neighborhood to evaluate the collective sentiment on the inventory.

Additional, one may even conduct polls to gauge the market sentiment for a selected inventory. Moreover, a key USP of the platform is that it permits individuals to share their ideas on the platform within the type of playing cards. These playing cards permit inventory market consultants or merchants to stipulate anticipated upsides or downsides, specify timeframes, and embody a quick rationale for his or her predictions.

The platform then scores customers based mostly on these predictions. The scoring system helps the corporate keep transparency with its customers concerning the suggestions they see on their screens and the place they’re coming from

The app additionally provides an intensive breakdown of vital funding data like worth to earnings, worth to e book, return on fairness, revenues, revenue/loss, and so forth.

After its launch in March, the platform added 7-8K customers throughout the first 10 months. To speed up this momentum, the founder elevated engagement with SEBI-registered funding advisors. These advisors now share their inventory predictions on OpiGo.

The technique has helped increase OpiGo’s person base to 50K buyers. Now, the platform is concentrating on a person base of 1 Lakh by the top of the present fiscal 12 months. To realize this, the founder plans to stay along with his thesis — securing extra endorsements and inventory suggestions from funding advisors and strategists.

OpiGo’s Income Mannequin & The Street Forward

About three months in the past, the startup launched a subscription mannequin to help retail buyers in direct fairness investments, leveraging insights from a curated panel of SEBI-registered consultants.

With a single subscription, customers achieve entry to suggestions from a number of consultants. The system automates purchase/promote alerts through WhatsApp and the OpiGo app.

Month-to-month subscriptions are priced at roughly INR 700, whereas annual plans can be found for round INR 5,000. The platform’s paid subscriber base has grown to 1,000.

The platform has one other income stream, which is neatly interlaced with its commissions or reward system.

“Profitable predictions earn pockets credit, which might be redeemed as reductions on present playing cards, making the method rewarding and fascinating. On each present card buy, we earn a fee of 1-5% from the manufacturers,” Mehta stated.

In the meantime, the founder is focussed on creating a number of income streams to realize an annual income run fee (ARR) of $5 Mn by the top of the fiscal 12 months. As an example, within the brief time period, the startup plans to supply branded present playing cards at a reduction to customers with a set margin. This distribution will work by the startup providing customers present playing cards based mostly on their scores.

As well as, OpiGo is making a B2B income stream, which plans to take reside by the top of the month. Beneath this, OpiGo will mixture curated SEBI-registered consultants and their suggestions to inventory brokers through API options. The startup can also be seeking to increase its horizons to incorporate mutual funds, unlisted shares, and insurance coverage advisory as effectively.

Nonetheless, all these plans as of now are depending on the startup’s capacity to lift exterior funding. Since its inception, the startup has raised INR 1.50 Cr from buyers like Manish Choksi of Asian Paints and Shubham Satyarth of Sharpely. As of now, the founder has set his eyes on elevating further funds within the first quarter of FY26.

Transferring on, the founder’s journey till now has been focussed on streamlining the funding journey of a modern-day investor, who’s uncovered to the cacophony of half-baked inventory concepts and shallow predictions.

Together with his community-driven platform, run by SEBI-registered consultants, the founder seeks to offer a reputable various to the world of monetary recommendation, which is at present being overshadowed by the rising neighborhood of finfluencers.

To not point out, the shortage of authenticity and the danger of falling prey to fraudulent schemes have made the necessity for regulated and dependable platforms like OpiGo extra urgent than ever.

For now, whereas the actual problem lies in sustaining belief and scaling sustainably in a sector the place misinformation and fast positive factors typically overshadow knowledgeable decision-making, the platform’s future is strongly linked to the ever-evolving regulatory volatility within the nation.

[Edited By Shishir Parasher]