February 01, 2025 marks the presentation of Indian Union Budget for 2025, and we have summarized the important highlights from this budget, presented by Finance Minister, Nirmala Sitaraman.

The big highlight of this budget is that there is Zero Income Tax payable up to ₹12 Lakh under the new tax regime.

Table of Contents

Slab Rates in the New Tax Regime of Indian Union Budget:

If Up to ₹12,00,000

- Nil – 87A Rebate on income other than Special Rates income

If above ₹12 Lakh

- 4,00,001 to 8,00,000 – 5%

- 8,00,001 to 12,00,000 – 10%

- 12,00,001 to 16,00,000 – 15%

- 16,00,001 to 20,00,000 – 20%

- 20,00,001 to 24,00,000 – 25%

- Above 24,00,000 – 30%

Still waiting for the fine print to come as Devil is always in the details. New Income Tax Act to be presented in Parliament next week.

Detailed Breakdown of Indian Union Budget 2025

Other important highlights of the Indian Union Budget are mentioned below:

General

- Kisan Credit Card limit enhanced from ₹3 lakh to ₹5 lakh

- Additional Infra in 5 IIT’s set up after 2014. IIT Patna to be expanded

- 10,000 more seats to be added in medical colleges in next year and 75,000 in next five years

- ₹500 Cr. for Centre for Excellence in AI

- Social Welfare Scheme for GIG workers

- Extension of Jal Jeevan Mission till 2028

- Urban Challenge Fund of ₹1 lakh crore to be set up

- Green field airports to be facilitated in Bihar in addition to Patna airport

- ₹20,000 Cr. for Private Sector R&D

- Top 50 tourist destinations to be developed. Focus on destinations linked to Budha

- ‘Heal in India’ to be promoted

- FDI limit for Insurance sector to be raised to 100% if entire premium invested in India

- Revamped KYC Registry to be rolled out

- Customs: Rationalize tariff structure

- 136 life saving drugs exempt from duty & 5% duty on 6 life saving drugs.

Direct and Indirect tax

- New Income tax Bill Next Week

- New Income tax Bill to be simple and close to present

- Personal Income Tax Reforms for Middle class

- NIL Income tax upto ₹12,00,000

- Income Tax slab changed

- TDS and TCS rationalize

- Limit for TDS on rent increased from ₹2.4 lakh to ₹6 lakh

- Limit for TDS on Senior citizens enhance from ₹50,000 to ₹1,00,000

- TCS removed on remittance for education purposes

- ‘Updated Return’ time limit enhanced to 4 years from present 2 years

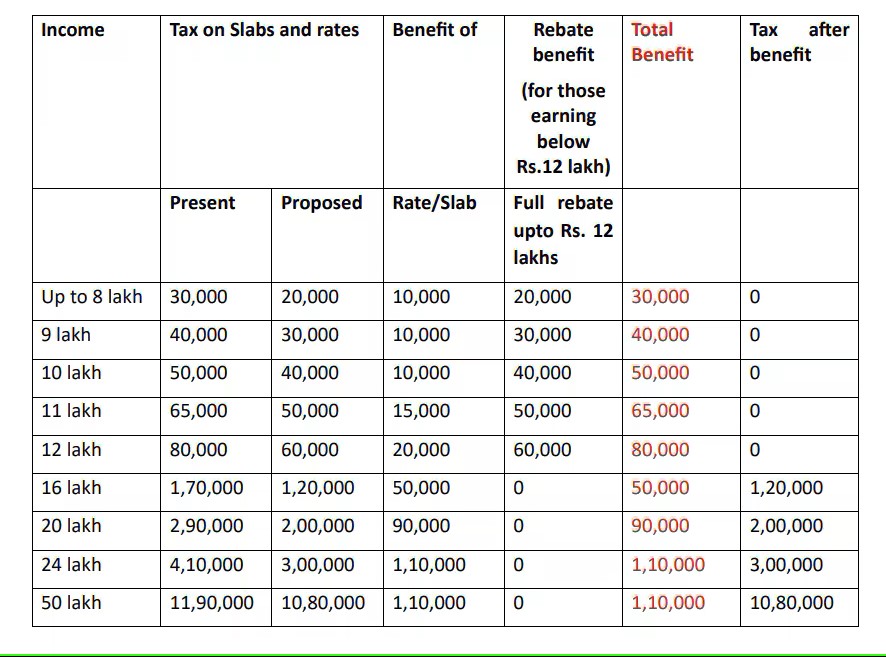

Below mentioned is the Chart to showcase the Total Benefit arising due to the Proposed Changes.

Discussion on Amendments:-

- The Union Budget 2025-26 has extended the time limit to file the Updated Return (ITR-U) from 24 months to 48 months from the end of the relevant assessment year, this will allow the tax payers more time for filing of Updated Return.

Due to the effect of this provision , now the additional tax payment percentages have been updated as follows:

a. Filed within 12 months: 25%

b. Filed within 24 months: 50%

c. Filed within 36 months: 60%

d. Filed within 48 months: 70%

This amendment will take effect from 1st April, 2025.

We will keep updating the post as we keep getting further updates. Stay tuned for more details.