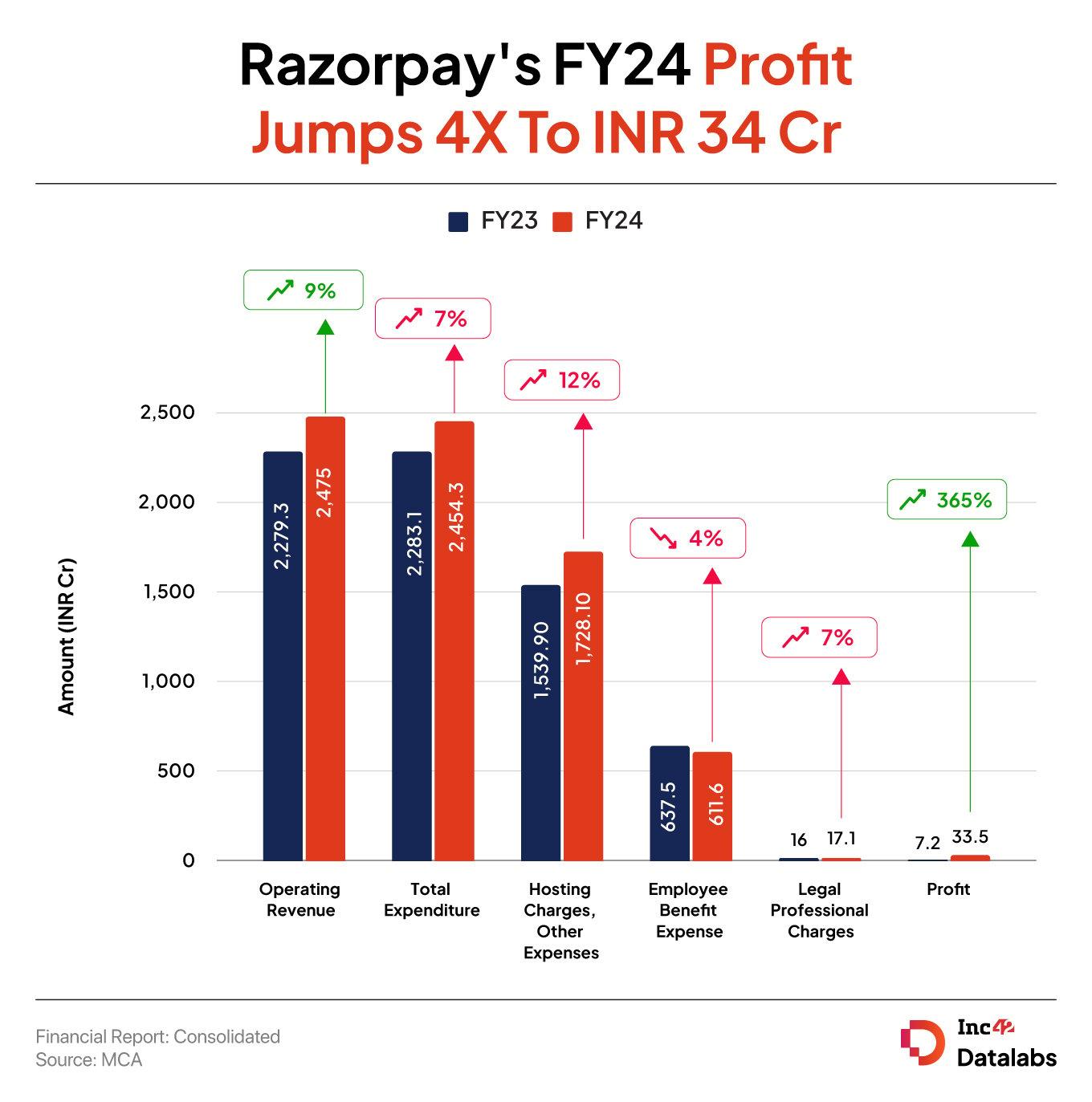

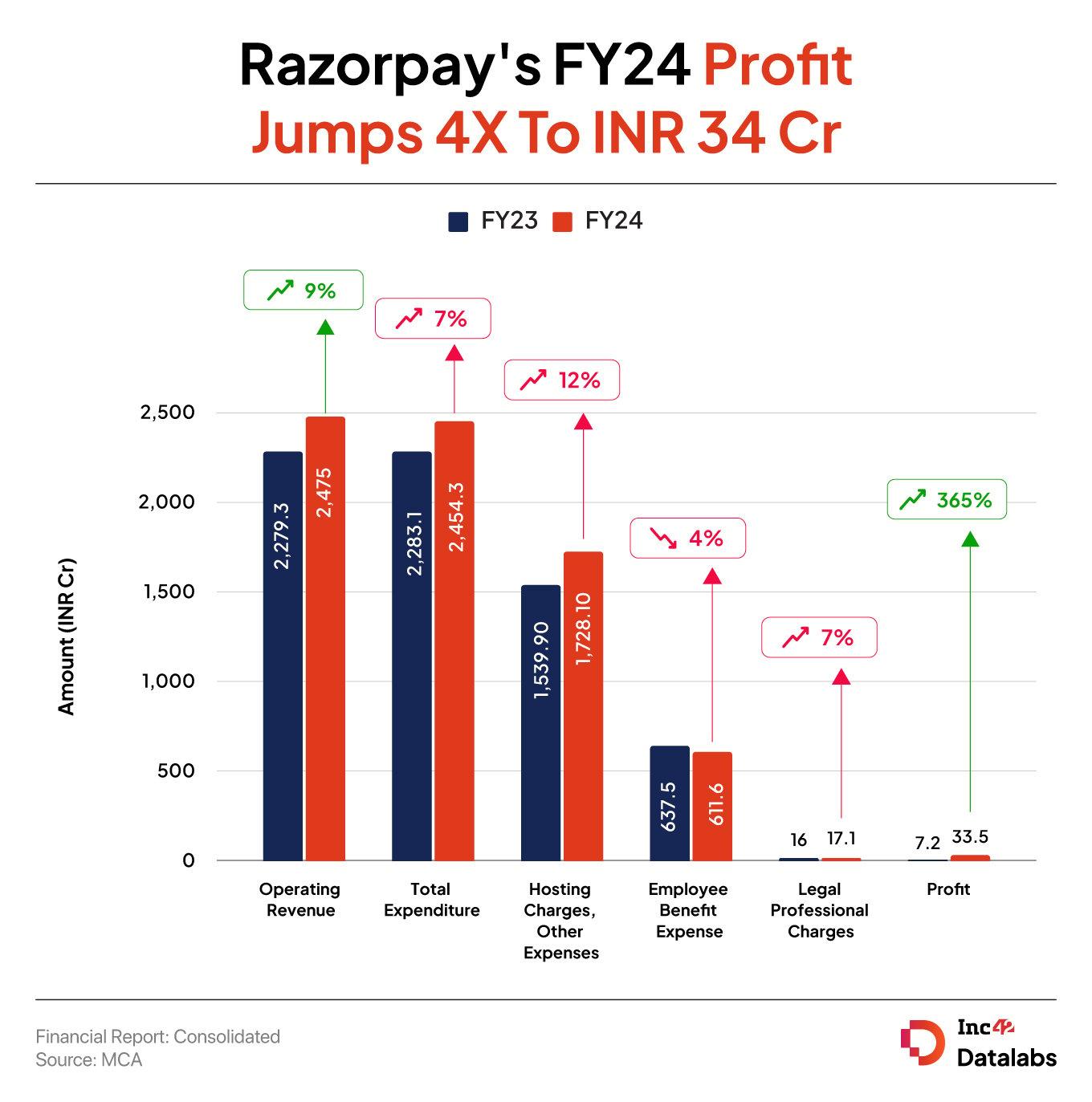

Bengaluru-based fintech unicorn Razorpay’s revenue jumped by over 4X within the monetary 12 months ending on March 31, 2024. The Peak XV-backed startup has reported a revenue of INR 33.5 Cr, a 365% leap from INR 7.2 Cr it reported within the earlier 12 months.

The startup’s rise in revenue is credited to its improve in working income. In FY24, the startup’s working income rose by 9% to INR 2,475 Cr as against INR 2,283 Cr in the previous fiscal year.

The startup generates most of its income by means of fee fee charges that it earns by offering on-line fee companies to retailers. Because of this it earned INR 2,068.1 Cr from fee aggregation companies, which is 83% of the startup’s whole working income in FY24.

Together with different revenue, the startup’s whole income stood at INR 2,501.4 Cr in FY24, a 9% increased than INR 2,279.3 Cr within the earlier fiscal 12 months.

Based by Shashank Kumar and Harshil Mathur in 2014, Razorpay is an omnichannel funds and banking platform. The startup has forayed into SME payroll administration, banking, lending, funds, insurance coverage amongst others through the years.

The place Did Razorpay Spend?

The fintech startup managed to regulate its bills throughout the 12 months beneath assessment with the rise in working income outpacing the rise in its expenditure. In FY24, the startup’s whole expenditure stood at INR 2,454.3 Cr, a 7% improve from INR 2,283.1 Cr it reported final fiscal 12 months.

Internet hosting Prices, Different Bills: As per the startup’s monetary statements, the startup spent INR 1,728.1 Cr for its internet hosting fees, this was 12% increased than INR 1,539 Cr within the earlier 12 months. Moreover internet hosting fees, this expense head additionally includes promoting expenditure, thus making it the most important expenditure.

Worker Prices: Apparently, the startup’s worker prices took a minute dip within the ongoing monetary 12 months. In FY24, the startup spent INR 612 Cr, a 4% decrease than INR 637.5 Cr, indicating dip in worker headcount.

Authorized Skilled Prices: The startup spent INR 17.1 Cr as authorized skilled bills in FY24, a 7% increased than INR 16 Cr it spent within the earlier fiscal 12 months.

The startup’s money and money equivalents on the finish of the monetary 12 months stood at INR 902 Cr, 1.2% decrease than INR 913.5 Cr in FY23.

The startup has raised over $740 Mn, with notable traders together with GIC, Tiger World, and Lightspeed Ventures. In its newest funding, i.e. in December 2021, it secured $375 Mn at a valuation of $7.5 Bn.

Earlier this 12 months, the startup’s offline funds arm – Razorpay POS launched Q-Zap for offline retailers to cut back billing time. Final month, it launched DataSync, a no-code knowledge integration platform that claims to supply real-time knowledge entry to allow companies to well timed enhance their monetary reporting and strengthen fraud detection.

Razorpay is among the many rising lists of Indian tech startups which might be shifting their domicile from foreign land to India to avoid wasting taxes and in addition to checklist the corporate within the nation’s inventory exchanges. As per media stories, the startup should find yourself paying $200 Mn (~ INR 1,600 Cr).